The Business Debt Collection Statements

Wiki Article

The Facts About Debt Collection Agency Revealed

Table of ContentsExcitement About Business Debt CollectionThe Only Guide to International Debt Collection6 Easy Facts About Dental Debt Collection DescribedPrivate Schools Debt Collection for Dummies

A financial debt collector is a person or organization that remains in business of recouping cash owed on overdue accounts. Many financial obligation collection agencies are hired by business to which cash is owed by people, running for a flat fee or for a portion of the quantity they are able to collect.

A debt enthusiast may additionally be referred to as a debt collector. Below is just how they work. A debt collector tries to recoup past-due financial debts owed to lenders. Financial obligation enthusiasts are frequently paid a percentage of any type of money they handle to gather. Some financial debt enthusiasts acquisition overdue financial debts from creditors at a discount and then seek to collect on their very own.

Financial debt enthusiasts that breach the policies can be filed a claim against. When a consumer defaults on a financial debt (significance that they have actually stopped working to make one or more needed repayments), the loan provider or lender may transform their account over to a financial obligation collection agency or collections firm. At that point the financial debt is said to have gone to collections (International Debt Collection).

Some business have their very own financial obligation collection divisions. Many find it much easier to work with a debt collector to go after unsettled debts than to chase after the clients themselves.

The Greatest Guide To Business Debt Collection

Financial obligation enthusiasts might call the individual's personal and also work phones, and also even turn up on their doorstep. They may additionally contact their household, friends, as well as next-door neighbors in order to confirm the call info that they have on declare the person. (Nevertheless, they are not allowed to divulge the reason they are trying to reach them.) In addition, they might send by mail the borrower late payment notices.m. or after 9 p. m. Nor can they incorrectly declare that a borrower will certainly be jailed if they fall short to pay. Furthermore, a collection agency can't literally damage or threaten a debtor as well as isn't enabled to take possessions without the authorization of a court. The legislation also offers borrowers certain legal rights.

Individuals that assume a financial obligation collector has broken the legislation can report them to the FTC, the CFPB, and also their state chief law officer's office. They likewise have the right to take legal action against the financial debt collection agency in state or government court. Yes, a financial debt collection agency may report a financial debt to the credit rating bureaus, yet review only after it has actually spoken to the debtor concerning it.

Both can stay on credit records for up to 7 years and have an adverse impact on the person's credit history, a large portion of which is based upon their payment history. No, the Fair Debt Collection Practices Act uses only to customer financial debts, such as home loans, credit report cards, auto loan, pupil finances, and also medical bills.

A Biased View of Personal Debt Collection

When that happens, the IRS will send out the taxpayer an official notification called a CP40. Because scams prevail, taxpayers need to watch out for any person purporting to be working with part of the internal revenue service and consult the internal revenue service to make certain. That depends upon the state. Some states have licensing needs for financial obligation collectors, while others do not.Financial obligation enthusiasts give a beneficial service to lending institutions and various other lenders that want to recover all or part of cash that is owed to them. At the exact same time, the regulation offers particular consumer defenses to keep debt enthusiasts from coming to be also hostile or abusive.

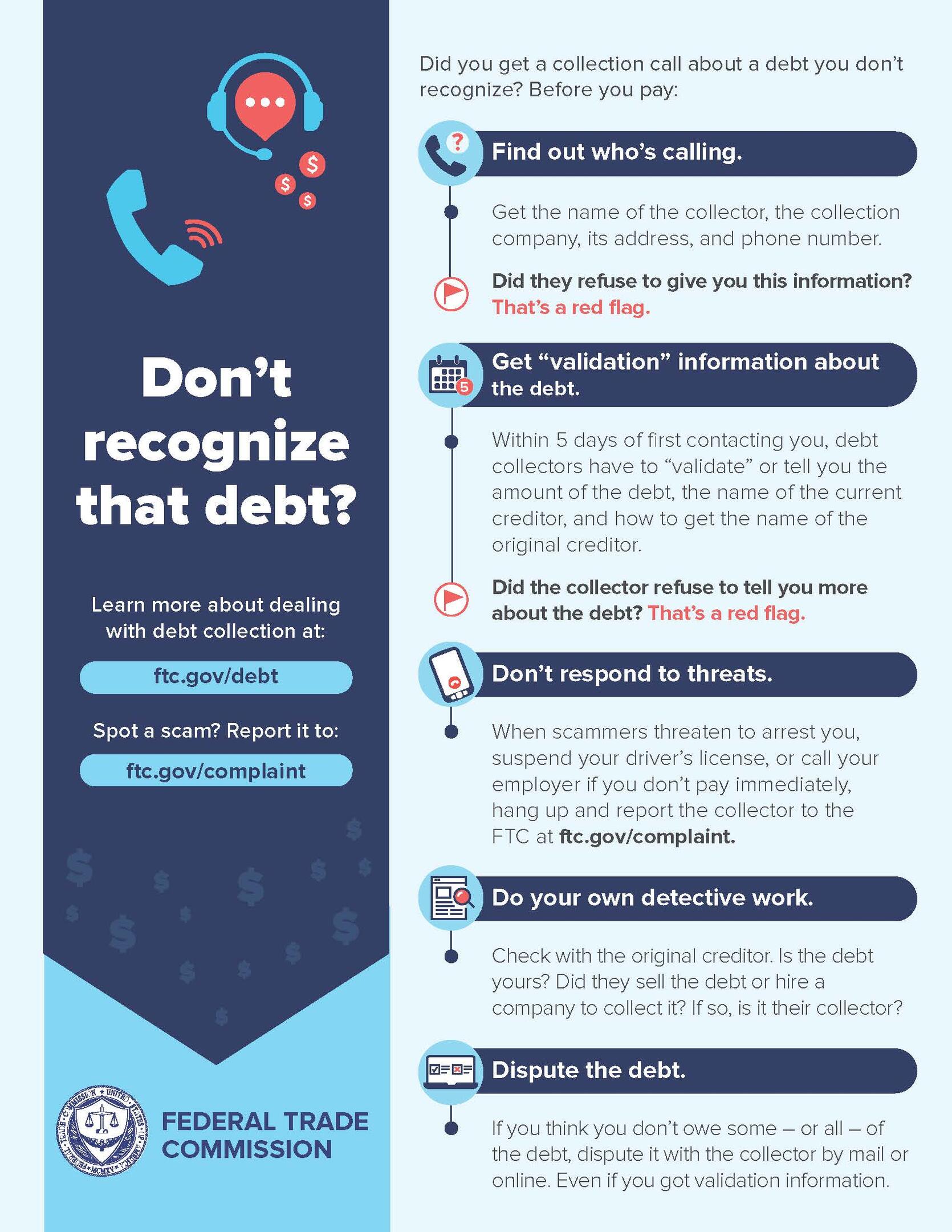

Normally, this information is supplied in a composed notice sent out as the first communication to you or within 5 days of their very first interaction with you, as well as it may be sent out by mail or online.

This notification normally needs to consist of: A statement that the interaction is from a financial debt collector, Your name and mailing info, in addition to the name as well as mailing details of the financial debt enthusiast, The name of the lender you owe the debt to, It is feasible that greater than one lender will be noted, The account number related to the financial debt (if any)A useful link breakdown of the existing quantity of the financial debt that shows interest, charges, settlements, and credit scores since a specific date, The current amount of the financial debt when the notification is provided, Info you can utilize to reply to the financial obligation collection agency, such as if you believe the financial debt is not your own or if the quantity is wrong, An end date for a 30-day duration when you can dispute the debt, You may see other Click This Link details on your notice, however the info detailed over typically must be included.

Some Known Questions About International Debt Collection.

Discover more concerning your financial debt collection defenses..

Claim, you don't pay a charge card expense for several billing cycles. A rep of that card issuer's collection department may get to out to demand payment. When a debt goes unsettled for numerous months, the original lender will commonly offer it to an outdoors company. The buyer is recognized as a third-party financial debt collection agency."Debt collector" is an additional term utilized to explain third-party financial debt collectors.

The FDCPA lawfully determines what financial debt enthusiasts can and also can't do. For instance, they must inform you the quantity of the debt owed, share info concerning your rights as well as explain just how to challenge the financial debt. They can likewise sue you for repayment on a financial debt as long as the statute of limitations on it hasn't expired.

Report this wiki page